While valuing an organization using Discounted Cash Flow (DCF), forecasted Free Cash Flow (FCF) is discounted by the Weighted Average Cost of Capital (WACC). WACC represents the opportunity cost of capital for investors when they allocate their funds towards a business.

WACC can be calculated using the following formula:

WACC = D/V x Kd (1 – T) + E/V x Ke

Where,

D/V = Debt to Enterprise Value (EV) based on market value

E/V = Equity to EV based on market value

Kd = Cost of debt

Ke = Cost of equity

T = Company’s tax rate

None of the above components are readily available. Hence, we use various models, assumptions and approximations to arrive at each of the values. There are 3 important factors that need further attention.

- Cost of equity is depended on (1) Risk-free rate (2) Market risk premium and (3) Beta. We employ CAPM to estimate the cost of equity.

- After-tax cost of debt depends on (1) Risk-free rate (2) Default spread and (3) Marginal tax rate. For an investment grade company, we employ yield to maturity (YTM) on its long-term debt, and for a public company, we use YTM on bonds’ cash flows and price.

- Capital Structure (proportion of debt and equity to the EV). The target capital structure is derived by the company’s current debt-to-value ratio. We always use the market values (and not the book values).

Couple of points noteworthy:

- WACC based models works well when a company maintains a relatively stable debt-to-value ratio. But for a LBO, it can understate or overstate the impact of the tax shield. In such a situation, we should discount the FCF at unlevered cost of equity and value tax shields separately.

- If a company’s debt-to-value ratio changes, we use Adjusted Present Value (APV).

Let’s take an example. Consider a startup wants to raise a capital of $1 million so that it can buy office space and equipments needed to run its business. The company issues 6,000 shares at $100 each to raise $600,000. The shareholders expect a return of 10% on their investment. So, the cost of equity is 10%.

The company then issues 400 bonds of $1,000 each to raise $400,000. The bondholders expect a return of 8%. So, the cost of debt is 8%.

Now, the startup’s total market value ($600,000 equity + $400,000 debt) = $1 million. Let’s assume its tax rate is 35%. So, the company’s WACC is 6%

(($600,000/$1,000,000) x 0.1) + [(($400,000/$1,000,000) x .08) x (1 – 0.35))] = 0.0598 ~6%

This means that for every $1 the start-up raises from its investors, it must return $0.06 to them.

You may also want to read about Enterprise Value here.

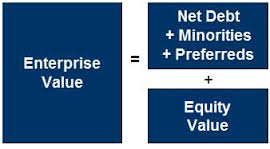

Enterprise Value (EV) or Firm Value is an economic measure that indicates the total value of a company. It measures how much an acquirer needs to pay to buy a company. It’s one of the fundamental metrics used in business valuation and portfolio analysis.

Enterprise Value (EV) or Firm Value is an economic measure that indicates the total value of a company. It measures how much an acquirer needs to pay to buy a company. It’s one of the fundamental metrics used in business valuation and portfolio analysis.